Polyester Yarn is at the forefront of policy changes in the textile industry. New regulations focus on enhancing material safety, reducing environmental impact, and ensuring product quality. These updates promote sustainable practices and innovation in textile manufacturing.

As global industries face rising pressure to decarbonize, חוט פוליאסטר—a key synthetic fiber used across textiles, home furnishings, and industrial fabrics—is entering a transformative policy era. In 2025, manufacturers and exporters must navigate not just technical performance demands, but also a growing web of environmental regulations.

From China’s dual-carbon strategy to the EU’s Carbon Border Adjustment Mechanism (CBAM), these developments are reshaping sourcing, production, and global competitiveness.

For companies that produce or trade חוט פוליאסטר, 2025 marks a critical inflection point. The fiber’s strong, wrinkle-resistant properties once made it a default choice for fast fashion and industrial textiles. But now, stakeholders are re-evaluating every stage of the חוט פוליאסטר value chain—from raw material sourcing to end-of-life recyclability—through a sustainability lens. The result is a shift in market priorities, where compliance, innovation, and environmental performance converge.

At textilessupplychain , we are committed to helping brands, manufacturers, and global importers make informed decisions through traceable sourcing, certified eco-solutions, and policy-aligned guidance tailored to the evolving חוט פוליאסטר landscape.

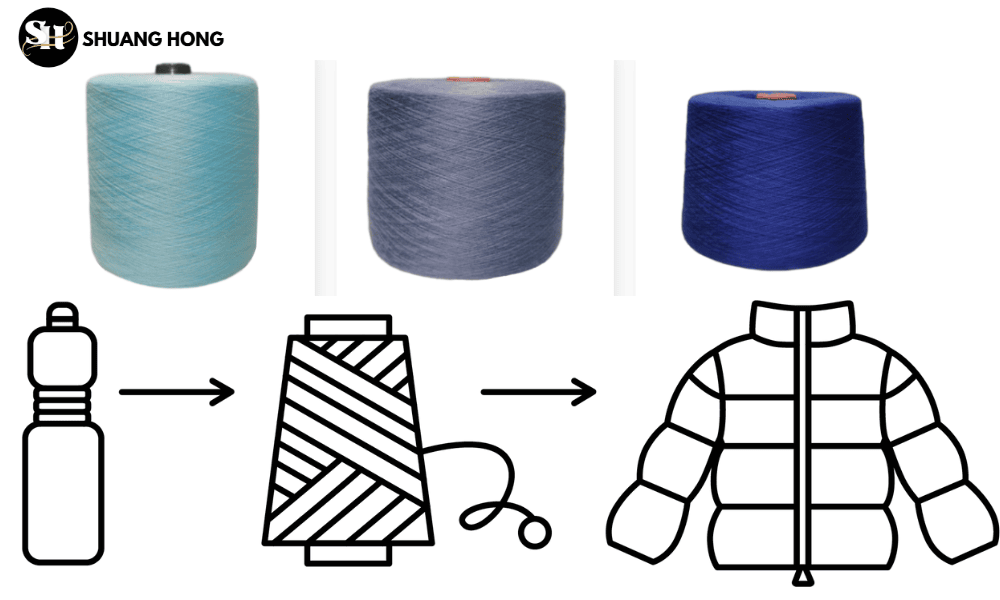

Color Polyester FDY

Policy trends for Polyester Yarn under global carbon reduction targets

Global climate initiatives are directly impacting synthetic fiber industries. The Paris Agreement, the UN Global Plastics Treaty (under negotiation), and voluntary pacts like the Textile Exchange’s Recycled Polyester Challenge are encouraging a transition from virgin to recycled or bio-based חוט פוליאסטר. In 2025, many international buyers will only source materials with traceable, low-carbon credentials.

At the core of this transition is the life-cycle impact of חוט פוליאסטר, which traditionally derives from fossil-based PET (polyethylene terephthalate). To meet carbon reduction goals, governments are pushing for measurable reductions in Scope 1, 2, and 3 emissions throughout the textile supply chain. This means producers must assess their energy sources, production emissions, and product-level carbon intensity.

חוט פוליאסטר manufacturers must now offer detailed environmental disclosures and increasingly align with frameworks such as ISO 14067 (carbon footprint of products), GHG Protocol, and Life Cycle Assessments (LCA). In this context, low-carbon or recycled חוט פוליאסטר has become both a compliance tool and a competitive differentiator.

At textilessupplychain, we provide product-specific support on carbon disclosure and supply verified חוט פוליאסטר variants aligned with these international frameworks.

Regulation and incentives for polyester yarn production under China’s dual carbon strategy

China, the world’s largest producer of חוט פוליאסטר, is also one of its most regulated markets. Its dual carbon strategy—peaking carbon emissions by 2030 and achieving carbon neutrality by 2060—has placed pressure on high-energy industries, including textiles. The polyester sector, which accounts for a significant portion of China’s industrial emissions, is now subject to both regulatory restrictions and targeted incentives.

Provincial governments are rolling out carbon intensity benchmarks for polyester yarn production facilities. New permits for high-emission expansion projects are increasingly withheld. Conversely, companies that invest in green production technologies (e.g., waste heat recovery, low-temperature dyeing, or renewable-powered spinning) receive subsidies, tax relief, or green financing.

textilessupplychain works closely with Chinese production hubs to ensure every חוט פוליאסטר batch we export meets national environmental targets and satisfies international buyer requirements.

Export response strategies for Polyester Yarn under the EU CBAM mechanism

The EU’s Carbon Border Adjustment Mechanism (CBAM), entering its transitional phase in 2025, poses a significant challenge to global Polyester חוט exporters. Although polyester textiles are not yet directly listed in the CBAM scope, upstream products—especially petrochemical inputs and energy-intensive manufacturing steps—may be indirectly affected.

Under CBAM, importers must report embedded carbon emissions in select goods. By 2026, emissions will be taxed based on the EU Emissions Trading System (ETS) benchmark. As חוט פוליאסטר is produced through energy- and heat-intensive polymerization and spinning processes, it could soon be indirectly included through expanded CBAM categories.

This implies that חוט פוליאסטר exporters aiming at the EU must now calculate and report product-level carbon intensity. At textilessupplychain, we support clients with ready-to-submit environmental documentation and verified chain-of-custody data that can help reduce CBAM exposure.

פוליאסטר FDY

How green certification affects international trade access for Polyester Yarn

Beyond emission disclosures, sustainability certifications are becoming mandatory for trade participation. Standards such as GRS (Global Recycled Standard), OEKO-TEX, Bluesign, and Higg Index ratings are no longer optional—they serve as procurement prerequisites for major apparel and home textile brands.

textilessupplychain maintains a full library of certified חוט פוליאסטר offerings—mechanically and chemically recycled, bio-based, and solution-dyed. Each product batch is traceable and verifiable with third-party certificates, easing buyer concerns and accelerating customs clearance in sensitive markets.

Market acceleration for recycled Polyester Yarn under policy guidance

The global market share of recycled Polyester Yarn is projected to exceed 60% by 2030, thanks largely to regulatory and retail pressure. Government policies that restrict landfill use, promote circular economy models, or ban virgin plastics in textile applications are creating strong demand signals.

Brands such as Adidas, H&M, and Decathlon have pledged to eliminate virgin polyester by 2025 or shortly thereafter. This has pushed Tier 1 suppliers to secure stable supplies of rPET-based Polyester Yarn, ensuring consistent performance and color reproducibility.

textilessupplychain ensures long-term, scalable access to GRS-certified חוט פוליאסטר, with flexible MOQ, rapid shipment timelines, and strategic warehousing across Asia.

Support and regulatory trends for the Polyester Yarn industry in Southeast Asian countries

Southeast Asia—home to major textile processing hubs like Vietnam, Indonesia, and Thailand—is actively crafting sustainability roadmaps. Countries are aligning with global trade partners by embedding green rules into export protocols.

With a strong regional supplier network, textilessupplychain is helping partners in Southeast Asia upgrade their חוט פוליאסטר lines through cleaner energy adoption, traceability technology, and export-market certifications—ensuring their yarn products are ready for Japan, EU, and US compliance.

Environmental advantages of solution-dyed Polyester Yarn driven by policies

One of the most promising eco-solutions for the חוט פוליאסטר industry is solution-dyeing—a process in which color is integrated during fiber extrusion, eliminating post-dyeing water usage and pollutants.

Compared to conventional piece dyeing, solution-dyed yarns reduce water usage by up to 80%, energy by 60%, and eliminate many dye chemicals that contribute to water toxicity. These advantages align with global SDG goals on water conservation and sustainable production.

textilessupplychain specializes in sourcing and developing solution-dyed Polyester Yarn solutions for brands that demand high colorfastness, UV durability, and deep compliance with water-saving regulations.

Digital transformation and traceability for Polyester Yarn supply chains

Traceability is emerging as both a regulatory requirement and a market necessity. Brands and governments increasingly demand transparency into every stage of חוט פוליאסטר production, from raw material sourcing to spinning, texturing, and transport.

textilessupplychain integrates digital QR labeling, order-level LCA documentation, and blockchain-enabled traceability protocols—empowering clients to meet the EU’s Ecodesign for Sustainable Products Regulation (ESPR) and other fast-approaching traceability mandates.

Polyester FDY Suppliers

As 2025 ushers in a new wave of environmental regulation, the חוט פוליאסטר industry finds itself at a pivotal crossroads. Global carbon reduction targets, national sustainability agendas, and market-driven certifications are no longer optional—they are reshaping how polyester yarn is produced, marketed, and exported.

Manufacturers who embrace recycled materials, clean production, and digital traceability will not only meet policy demands but unlock new opportunities in global value chains. On the other hand, those slow to adapt risk exclusion from major procurement systems and trade routes increasingly governed by green standards.

At textilessupplychain , we believe that חוט פוליאסטר must evolve from a commodity into a climate-conscious product, representing innovation, transparency, and responsibility. The fibers we spin today are not just part of a fabric—they are threads in a global narrative of sustainability and progress. In a world where regulations set the floor and consumers set the bar, now is the time for the industry to lead with integrity and foresight.

Let your yarn not only clothe the world—but help preserve it.

חדשות קודמות

A Low-Carbon Shift: How Global Policy Is Redefi...החדשות הבאות

Navigating the 2025 Policy Landscape for Polyer...

מאת Yarn

מוצר מומלץ

-

חוט פוליאסטר DTY 100D/144F

חוט פוליאסטר DTY 100D/144Fחוט פוליאסטר DTY 100D/144F: המדריך המלא...

-

חוט פוליאסטר DTY 100D/96F

חוט פוליאסטר DTY 100D/96Fחוט פוליאסטר DTY 100D/96F: הרך, היציב...

-

חוט פוליאסטר DTY 75D/144F SIM

חוט פוליאסטר DTY 75D/144F SIMחוט פוליאסטר DTY 75D/144F SIM: הבחירה הטובה ביותר עבור...